不是分析,不是买卖建议。

业务简介

*大众银行有限公司依据市值为马来西亚第二大银行,仅次于马来亚银行。

*属于一间华人资银行,于1966年成立,创办人为郑鸿标。1967年,该行在当时的吉隆坡证券交易所上市,于1990年代开始向香港、斯里兰卡、越南、老挝及柬埔寨扩展业务。

*大众银行目前拥有超过18,000名员工,国内外分行259间,其中香港79间、柬埔寨30间、越南13间、老挝4间、中国4间及斯里兰卡3间。

*集团提供全面的财务范围包括:

-Financial products and services comprising personal banking,

-commercial banking

- Islamic banking

- investment banking

-share broking

-trustee services

- nominee services, sale and management of unit trust funds

-bancassurance and general insurance products

大众银行的“成绩单”

SUMMARY OF FIVE-YEAR GROUP GROWTH

五年集团成长综述

季度表现比一比

业务分析 SEGMENTAL ANALYSIS

Group Corporate Structure 集团公司的结构 (22 FEB 2018 )

马来西亚首屈一指的银行之一

创始人和董事长的演说

*FY2017税前利润RM7.12 billion ,对比去年增加8.6% 。

*归属于股东的净利润RM5.47 billion,增加了5.1% 。

*Net return on equity 15.8% .

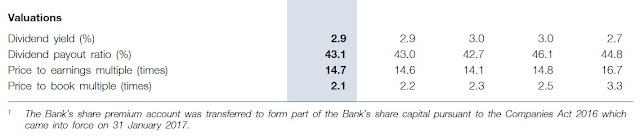

*Dividend 61 sen per share,股息支付23.6亿令吉,占集团2017年净利润的43.1%。

*今天的经营环境更具挑战性,银行业务也变得越来越复杂。

*科技的快速发展正在推动创新,也将改变我们的生活方式和新的经营方式。

*许多金融机构正在积极地探索提升的方法以便能满足客户的期望。

*Digital Banking Revolution 是银行未来的发展趋势。

*大众银行将继续通过推出更多电子付款方案和加强数字银行平台,以提升顾客体验。

*展望未来, 该集团相信其业务模式,坚实的基础,谨慎的经营方针建立强大的客户服务文化,在过去51年中不断成形和精炼使集团为未来的发展而奋进。

TAN SRI DATO’ SRI DR. TEH HONG PIOW

Founder and Chairman

22 February 2018

LETTER TO STAKEHOLDERS

*2017,全球经济普遍加强,包括美国、欧元区在内的主要经济体的复苏。日本和中国继续加强改善潜在的基本面。

*马来西亚2017年GDP强劲增长5.9%。

*银行一直保持谨慎发放贷款。

*2017,马来西亚银行体系的贷款和融资以较温和的速度增长4.1%,而总存款增长3.9%。

*银行继续善用拓展数码科技以提高效率。

*马来西亚国家银行(BNM)倡议把马来西亚变成一个无现金社会,比如减少使用支票,鼓励网上转账或支付卡等等

*Pin&Pay项目的实施支付卡PIN验证(Credit Card & Debit Card取消了签名验证,由输入Pin 密码取代)

*银行业的另一个重要里程碑开发是进一步推出移动钱包增强了国内支付服务的能力。

*随着银行保险(bancassurance)需求的持续增长,集团有信心能为集团的业务作出贡献。

*集团推行集中战略在有机增长的零售银行业务,特别是零售消费者的中小企业(“中小企业” “SMEs”),比如中小企业零售商业贷款、私营单位信托业务等等。

前景 OUTLOOK

*全球经济的强劲复苏,马来西亚经济可能继续受益,私人领域需要持续维持国内经济增长。

*全球油价预期的上升趋势也有可能预示马来西亚经济良好。

*值得留意的潜在风险如:货币政策收紧、贸易保护主义、全球地缘政治紧张局势.

顺带跟进TA SECURITIES 分析

Resilient Foreign Shareholding Level

Foreign investors have reportedly been reducing their exposure in Malaysian

stocks for several straight weeks. Most banking stocks were also subjected to

foreign selling pressures. Likewise, Public Bank (PBB) saw some softening in its

foreign shareholding level although we note that the level of attrition was not

as severe as the selldown experienced by some of its peers. Rising to an alltime

high of around 39.5% in March 2018, the foreign shareholding level has

only eased to around 39.1% (based on latest May data) since the General Election (GE).

Unwavering Strength

We believe the strength in PBB’s foreign shareholding levels reflects confidence

in the stock’s defensive qualities. Amid rising global volatilities and uncertainties

in the domestic market, PBB’s fundamentals remain sound. Boasting healthy

asset quality (with gross impaired loans (GIL) ratio 0.5% vs. industry’s 1.6%) of

and modest earnings growth prospects (of around 8%), we predict respectable

ROE of around 15% for FY18-20. Despite the implementation of MFRS 9,

management foresees stable asset quality as total credit charge for PBB is guided to be maintained below 15 bps.

Beneficiary of Pickup in Consumer Sentiments

Among others, our 8% earnings growth forecast is premised on a loan growth

projection of 5% coupled with stable net interest margin (NIM) of +2 bps YoY.

We believe the recent zerorisation of GST will provide some uplift to

consumer sentiments. We believe the auto segment would benefit most from

this short tax holiday due to attractive savings from not having to pay GST.

Commanding around 28.5% in market share and given its sizeable exposure of

16% in hire purchase to a total loan portfolio of RM306.8bn, we believe PBB could benefit from this spurt in consumer confidence.

Margin Compression a Downside Risk

Muting potential gains from the pickup in loans are risks from margin

compression. Despite the increase in OPR earlier in the year, we do foresee

margin pressures coming from certain segments of the loan market such as

residential mortgages as well as in the deposit space. Here, we note that PBB

has a market share of around 20% in the housing loan space. Given its sizeable

exposure of 36% in residential mortgages to total loans, we do foresee some

potential downside risk in NIM. Also posing some risk to NIM is the HP

portfolio as PBB recently launched a campaign to attract new car buyers

rushing to take advantage of the zero GST. As such, we foresee the HP segment to be subjected to some pricing pressure in 3QCY18.

Stronger Growth Envisaged from FY19

According to management, confidence, especially amongst the SMEs, have

improved post the GE. SMEs could benefit from this zerorisation of GST as

cash flows and process flows improve. SME retailers could also gain from

better sales due to the uplift in consumer sentiments coupled with Hari Raya

celebrations. Nevertheless, we do not expect better sentiments to immediately

translate into a surge in demand for loans for investment purposes, or business

activities as businesses and investors await more clarity in policy and

procedures from the new government.

We are more sanguine about PBB’s growth prospects in FY19 and FY20,

where we project net profit to improve by 8.6% and 9.1% YoY. Our forecasts

are premised on assumptions of stronger YoY loan growth of 7% and 9%,

healthier fee and FX income growth of around 10% along with management’s ability to keep credit charge and overhead expenses in check.

Valuation and recommendation

We make no change to our earnings estimates, for now. We maintain a

favourable view on PBB due to: 1) the bank’s lead in loans growth and ROE, 2)

operating efficiency (based on cost to income ratio and PBT per employee), 3)

beneficiary of a pickup in consumer and SME activities, and 4) resilient asset

quality. We foresee the bank to likely maintain its current dividend payout

ratio of around 43% as PBB strengthens its capital position ahead of additional

counter-cyclical buffers and Domestic Systemically – Important Bank (DSIB)

buffer, which are yet to be introduced by BNM. To recap, PBB Common

Equity Tier 1 (CET1) Capital Ratio and Total Capital Ratio stood at 12.2% and

15.8%, slightly below the sector’s 13.2% and 17.5% respectively.

However, given the increased market volatilities due to global trade tensions

and rising interest rates concerns, we readjust our assumption on market risk

premium for our Gordon Growth Valuation Model to 5.5%. Based on forward

FY19 earnings, we tweak PBB’s TP to RM25.80 from RM29.50. This values the

stock at an implied FY19e PBV of 2.2x. We reiterate our BUY

recommendation on PBB. Key upside/downside risks to PBB’s TP include: 1)

stronger-than-expected contributions from operations overseas, 2) further

spike in the sale of bancassurance and wealth management, 3) unexpected

increase in unemployment rate resulting in high default rates among retail

borrowers, and 4) potential outflow of foreign funds resulting in a sharp decline in the foreign shareholding level.

留下脚印 RM24.40 (10-8-2018)

如何分析银行股

全哥+牛奶冰 :如何分析银行股?( PART 1 基础篇)

Charles 乡下小子 :如何分析银行股?( PART 2 未来挑战篇)

全哥股票新手教室76:如何分析银行股(Part 3 利率的影响篇 )

全哥股票新手教室70:迷你年报篇8 MAYBANK (1155) 马银行 2017 Annual Report

喜欢的话请分享出去,“顺便”给个Like 或 Follow 因为这就是全哥的动力来源

v( ̄︶ ̄)y Just Do It~

By 全哥分享 (11/8/18)

进入股市就是要防止被“抢劫”, 独立思考, 因为,股价与股票的内在价值最终会取得平衡.

全哥股票&投资理财新手教室 (部落格)

全哥股票&投资理财新手教室 (Facebook)

您可能也有兴趣这些文章

目录分类

股票新手教室

书中黄金教室

理财新手教室

游戏王新手教室

健身新手教室

理财教室问诊篇

课外篇

技术篇

迷你年报篇

技术走火入魔教室

No comments:

Post a Comment